Medicare Champion, licensed insurance agents,

are open M-F 8am - 8pm ET.

Getting ready to pick Medicare?

Learning about Medicare will help you make an informed decision. This is the first in a series of articles on Medicare that will get you started on learning.

What is Medicare?

If you’re new to Medicare or helping someone with Medicare decisions, you might feel a bit overwhelmed. Medicare has many rules and options, making it tricky to navigate. But don’t worry! We’re here to help you understand Medicare, how it works, and find the right coverage for your needs.

UNDERSTANDING MEDICARE

Medicare is a Federal health insurance program for people 65 and older or those with certain illnesses like End-Stage Renal Disease (ESRD) or Lou Gehrig’s Disease (ALS). Over 67 million peopleare enrolled in Medicare.

MEDICARE VS. MEDICAID

Medicare and Medicaid sound alike but are different. Medicare is a Federal program for people 65 and older or with specific disabilities. Medicaid is a joint Federal and State program for people with limited income. Each State runs its own Medicaid program with its own rules.

WHEN AM I ELIGIBLE FOR MEDICARE?

You usually become eligible for Medicare at age 65. There are other criteria too for those under 65 because of disabilities or certain health conditions.

WHO IS ELIGIBLE FOR MEDICARE?

Most people can get Medicare at age 65. If not, you might qualify based on your spouse or ex-spouse’s work record. Special rules apply for divorced or widowed people. Also, about 15% of Medicare recipients are under 65 due to disabilities or specific health conditions.

HOW DO I ENROLL IN MEDICARE?

There are two ways to enroll in Medicare: automatic enrollment and self-enrollment.

1. Automatic Enrollment

If you’re already getting Social Security benefits, you’ll be automatically enrolled in Medicare at 65. Your Medicare card will arrive about 100 days before your 65th birthday.

2. Self-Enrolling in Medicare

If you’re not getting Social Security benefits, you will have to sign up yourself. The Initial Enrollment Period (IEP) lasts seven months, starting three months before your 65th birthday and ending three months after.

DO I HAVE TO ENROLL IN MEDICARE AT 65?

You don’t have to enroll at 65 if you have health insurance that offers a prescription that matches or exceeds the value of Medicare Prescription Drug Coverage. There’s a Special Enrollment Period (SEP) for those who delay enrollment because of employer coverage, ensuring you don’t have gaps in coverage or penalties.

HOW DO YOU FIND YOUR MEDICARE NUMBER?

Your Medicare number is on your red, white, and blue Medicare card. Always carry your card with you unless you have a Medicare Advantage plan, then use that card instead.

WHAT ARE THE PARTS OF MEDICARE?

Medicare has different parts, each covering specific healthcare services:

MEDICARE PART A: Covers hospital stays. The deductible is $1,632 per benefit period

MEDICARE PART B: Covers outpatient services. The deductible is $240 per year, and Medicare covers 80% of costs after that.

MEDICARE PART C (Medicare Advantage): Private insurance plans offering all benefits of Part A and B, plus extra coverage like prescription drugs, dental, vision or hearing coverage.

MEDICARE PART D: Covers prescription drugs, with premiums from $10 to $70 per month.

HOW MUCH DOESE MEDICARE COST?

Medicare costs include premiums, deductibles, copays, and coinsurance.

MEDICARE PART A: Free for most people with 10 years of Medicare taxes.

MEDICARE PART B: Standard premium is $174.90 per month

FILLING COVERAGE GAPS

Original Medicare has costs that you need to pay out-of-pocket, but there are ways to cover these gaps.

MEDIGAP PLANS: Help pay for costs not covered by Original Medicare.

MEDICARE ADVANTAGE PLANS: Provide extra benefits, often with lower premiums but may require using in-network providers.

PRESCRIPTION DRUG COVERAGE

Medicare Part D plans cover prescription drugs. Choose a plan that covers your medications and fits your needs.

MEDICARE VISION AND DENTAL COVERAGE

Original Medicare usually doesn’t cover vision or dental care unless medically necessary. Consider buying a separate vision or dental insurance or a Medicare Advantage plan with these benefits.

GETTING MEDICARE HELP

Medicare can be hard to understand. You can get help from licensed Medicare agents or brokers.

Gain a Better Understanding of Medicare

For more information on your Medicare options, read our other articles below or schedule time with a Medicare Champion today!

Medicare Enrollment

How do you enroll in Medicare? How does Medicare work with other insurance?

Understanding Medicare Supplement Plans

Learn about plans that complement Original Medicare

🇺🇸 Schedule your consultation now or call us with your questions.

MULTIPLAN_WEB_NTM_UGP_C

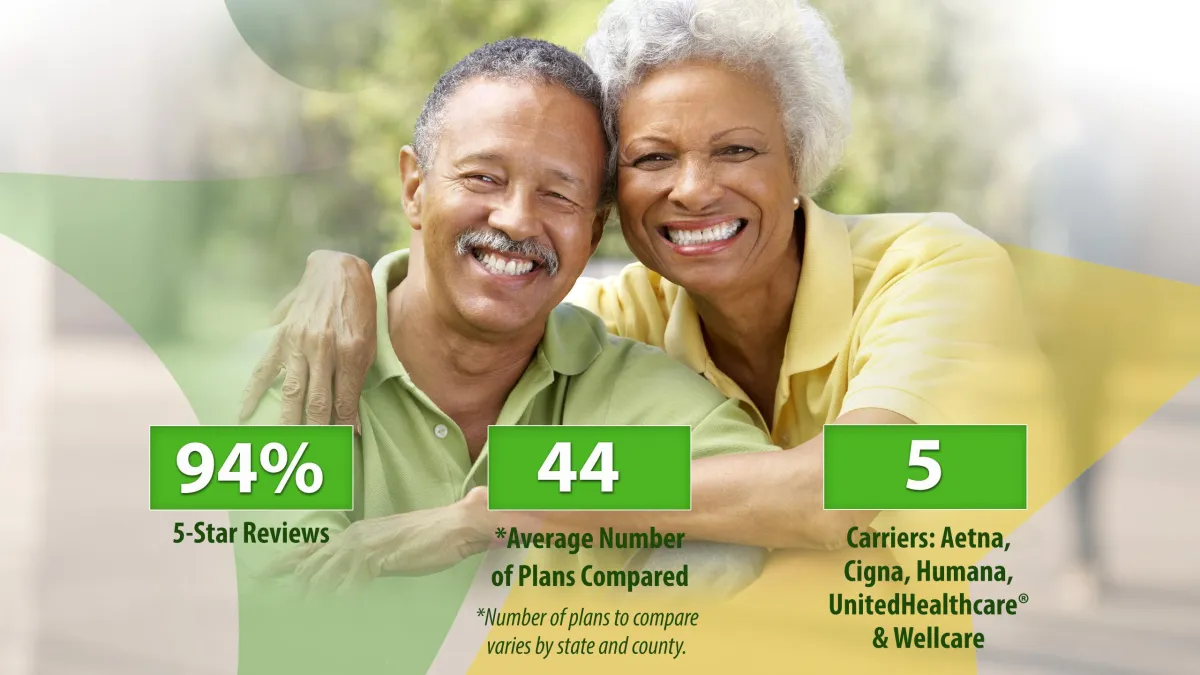

© 2025 Unified Growth Partners Corporation. (“UGP”), does business as Medicare Champion in all states except MA. UGP is a duly licensed insurance agency appointed by Medicare Advantage HMO, PPO and PFFS plans and stand-alone prescription drug plans and insurance companies holding Medicare contracts approved by The Centers for Medicare & Medicaid Services (CMS). UGP is not connected with or endorsed by the U.S. Government or the Federal Medicare Program. Enrollment in any plan for coverage is subject to insurance company approval. Enrollment in the plan depends on the plan’s contract renewal with Medicare. (Your IP address and/or location coordinates may be gathered to verify your location.) Sales agents may be compensated based on your enrollment in a health plan. PLEASE NOTE: Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Medicare Supplement plans are not connected with or endorsed by the U.S. Government or the Federal Medicare program. UGP complies with applicable Federal civil rights laws and does not discriminate on the basis of race, color, national origin, age, disability, sex, sexual orientation, gender identity, or religion. mymedicarechampion.com is a non-government site, powered by UGP. UGP provides a secure way to purchase Medicare insurance from the comfort of your home or workplace. We do not offer every plan available in your area. Currently we represent 5 organizations which offer 67 products in your area. Please contact Medicare.gov or 1-800-Medicare (TTY users should call 1-877-486-2048) 24 hours day/7 days a week, or your local State Health Insurance Program (SHIP), to get information on all of your options. Not all plans offer all of these benefits. Any information we provide is limited to those plans we do offer in your area.

Benefits may vary by carrier and location. Limitations and exclusions may apply. To send a complaint to Medicare, call 1-800-MEDICARE (TTY users should call 1- 877-486-2048),

24 hours a day/7 days a week). If your complaint involves a broker or agent, be sure to include the name of the person when filing your grievance.